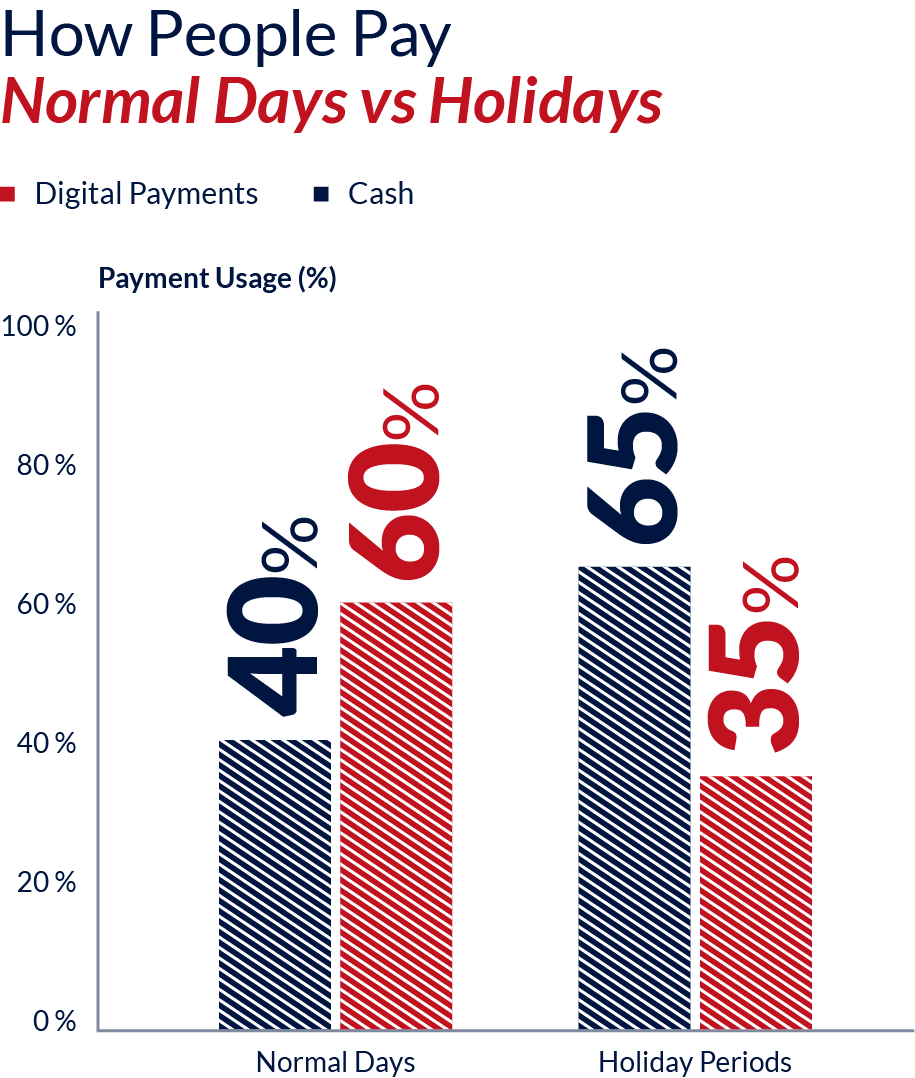

Digital payments have become part of everyday life—cards, mobile wallets, and banking apps make paying easy. But the reality of Digital Payments vs ATM Demand becomes clear during holiday seasons, when cash demand still rises. Even with digital options everywhere, people withdraw more cash and rely on ATMs more heavily during these busy periods.

Holiday events create crowded, fast-moving environments. In those moments, people often choose the quickest and most reliable payment method—cash. This is the real story behind digital payments vs cash during holidays.

The Holiday Effect

Holidays change how people shop and spend. More crowds, more pop-up vendors, more quick transactions. As activity increases, cash usage naturally goes up.

Why Cash Demand Increases During Holidays

-

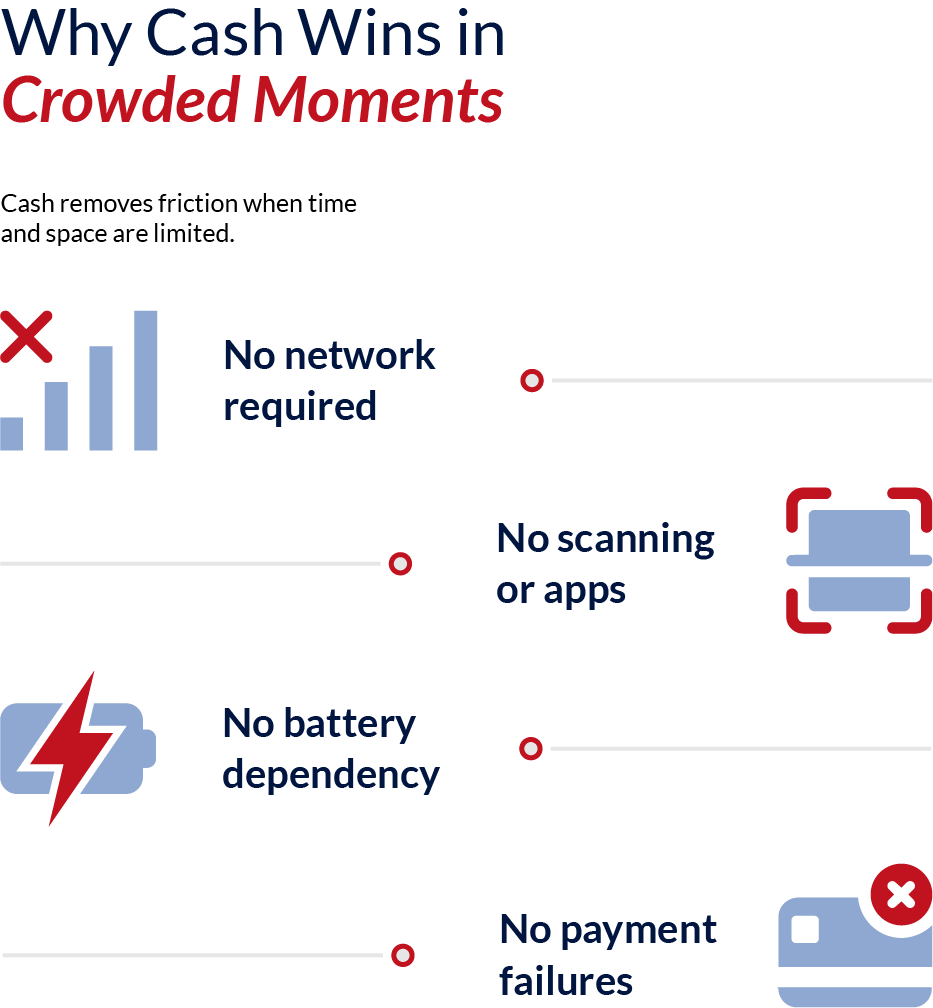

Cash Is Fast in Crowded Places

Holiday areas get busy. Lines are long, and people want quick checkouts. Cash eliminates issues like failed scans, slow networks, or payment errors. It works instantly, which drives higher holiday cash usage.

-

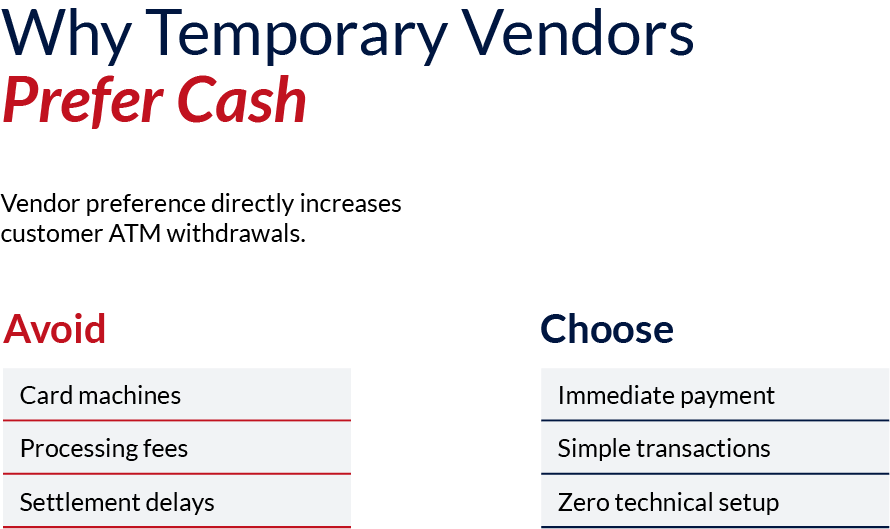

Many Holiday Vendors Prefer Cash

Pop-up stalls and temporary sellers often avoid:

- card machines

- transaction fees

- delayed settlements

Cash gives them money immediately. Because many vendors ask for cash, customers withdraw more, raising ATM demand.

-

People Use Cash to Control Spending

Holiday spending adds up—gifts, food, travel, decorations, events. Many people manage budgets better with physical cash in hand, leading to more ATM withdrawals.

Digital Payments vs Cash

Digital payments dominate daily life, but holiday seasons reveal their limitations.

Where Digital Payments Can Struggle

- network congestion

- weak mobile signals

- vendors lacking digital options

- dead phone batteries

- app or device failures

In these moments, people switch to cash because it’s dependable.

Cash Doesn’t Replace Digital, It Complements It

This isn’t cash vs digital. Most people use both. Digital works every day; cash becomes essential in high-traffic holiday environments.

How Holidays Increase ATM Demand

ATMs Become Critical During Holiday Seasons

Higher cash usage means more withdrawals. ATMs in strategic locations see major increases in transactions.

High Foot-Traffic Areas See the Biggest Surge

Best-performing ATM locations during holidays include:

- shopping districts

- event venues

- religious centers

- transportation hubs

- busy neighborhoods

What This Means for ATM Owners

Preparation Is Key

Holiday seasons can significantly boost ATM performance—but only if machines remain stocked and online.

Operators Should Plan Ahead

To capture increased holiday cash usage:

- Increase cash loads

- Monitor activity more frequently

- Minimize downtime

- Ensure quick service dispatch

Conclusion

Even with ongoing growth in digital payments, cash demand still rises during holiday seasons. People rely on cash because it’s quick, simple, and reliable during crowded, high-spending periods. That’s why ATM demand spikes during holidays and why planning ahead is crucial for ATM operators.

FAQs

- Why does cash demand increase during holidays?

Because crowded venues and temporary vendors make cash the fastest, most reliable payment option. - Why do people prefer cash at holiday events?

It works without internet, helps manage budgets, and is accepted everywhere. - Are digital payments replacing cash during holidays?

No. Digital is common, but cash remains essential in crowded or low-signal environments. - How do holidays affect ATM demand?

ATM transactions increase because people withdraw more cash for shopping, food, travel, and events. - Where are ATMs used most during holidays?

Shopping centers, event locations, transport hubs, and busy seasonal areas. - How can ATM owners prepare for holiday seasons?

Increase cash loads, monitor machines closely, and reduce downtime. - Is cash still important even with digital payments?

Yes. Cash is reliable and works regardless of connectivity. - Do holidays increase cash withdrawals every year?

In most cases, yes—especially in high-traffic areas with temporary vendors.