Every ATM business owner asks: can ATMs detect fake bills? In a world where counterfeit currency attempts continue, this concern is real. Understanding how ATMs verify cash, and where their limits lie, helps you manage risk, reassure customers, and maintain secure ATM processing in your network.

In this article, you’ll learn:

- How ATMs detect counterfeit banknotes

- The technologies behind detection

- Where ATMs may fail or allow a fake bill through

- What to do if a fake bill slips out

- How this relates to your role as an ATM operator

How Do ATMs Detect Counterfeit Bills?

Modern ATMs (and cash automation systems) incorporate multiple validation methods to flag suspicious banknotes. While not perfect, these systems make it very difficult for most fake bills to pass through. Can ATMs Detect Counterfeit Money?

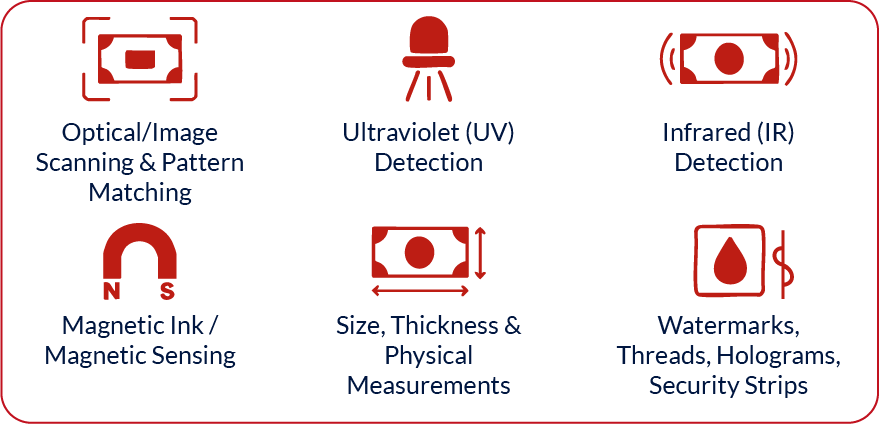

Here are the primary technologies used:

Multi-Layer Detection Technology in Modern ATMs

1. Optical/image scanning & pattern matching

When a note is inserted, the ATM’s sensing eye / validator captures a high-resolution image. It compares that image’s dimensions, line patterns, brightness, contrast, and microprint with templates for real notes of that currency and denomination. If mismatches appear, the bill is flagged.

2. Ultraviolet (UV) detection

Many genuine banknotes incorporate UV-sensitive security features that glow under ultraviolet light. The ATM’s UV sensor checks whether those features exist and match expectations.

3. Infrared (IR) detection

Infrared sensors test how parts of the bill absorb or reflect infrared light. Because counterfeit inks and substrates often behave differently under IR, this provides another layer of checking.

4. Magnetic ink / magnetic sensing

Some banknotes include magnetic ink in certain areas. The ATM’s magnetic detectors verify that magnetic signatures align with expected patterns. Counterfeit bills may lack the proper magnetic response.

5. Size, thickness & physical measurements

Genuine banknotes have strict tolerances in physical dimensions and paper thickness. Validators measure size, thickness, and sometimes stiffness, rejecting bills that deviate too much.

6. Watermarks, threads, holograms, security strips

Many currencies include embedded watermarks, metallic threads, holographic strips, or 3D ribbon features. ATMs can verify some of these via sensors or image scanning.

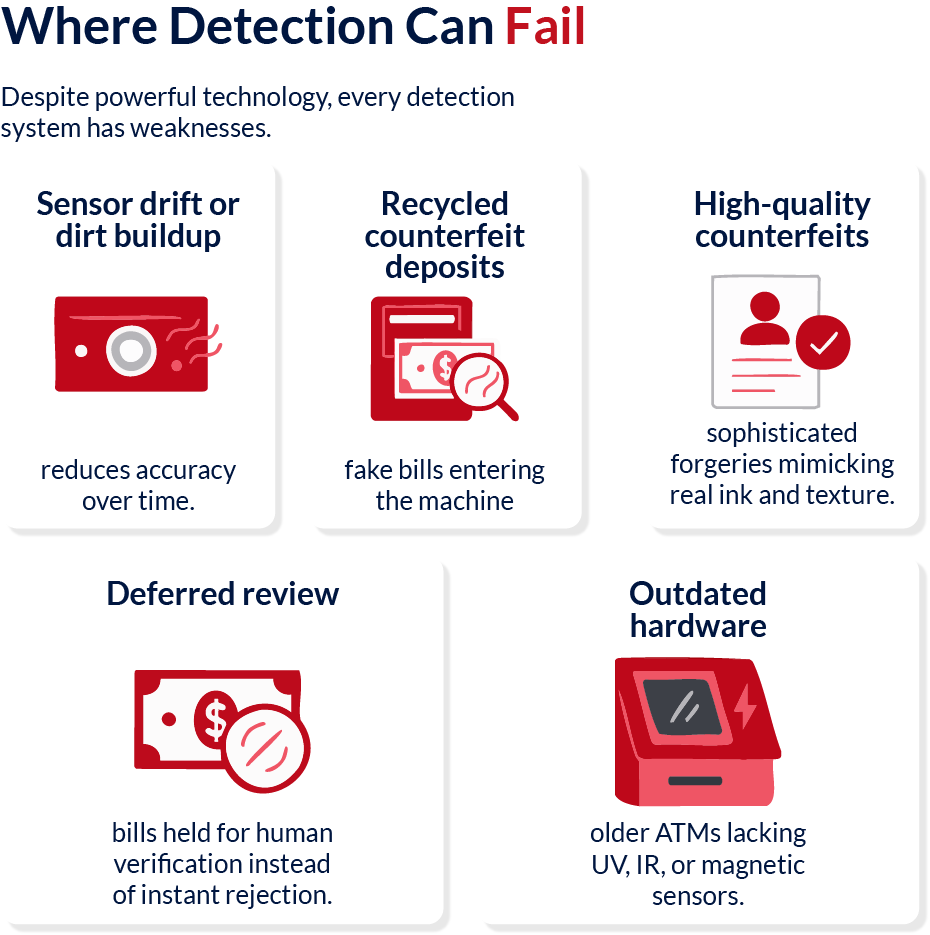

Are ATMs Perfect at Detecting Fakes? Limitations & Risks

While ATMs are sophisticated, they are not infallible. As an ATM operator, you should know where gaps may occur.

Machine errors or calibration issues

If sensors drift, calibration is off, or optical parts get dirty, the ATM might misclassify genuine bills as fake, or worse, let counterfeit ones pass as genuine, so, watch out for these errors.

Counterfeit notes entering via cash recycling

Some ATMs accept deposits and recycle cash for future withdrawals. If a counterfeit note gets deposited and not detected, it might later get dispensed as genuine cash.

Advanced, high-quality counterfeits

Very sophisticated fakes optimized to mimic magnetic, UV, IR, and physical properties may bypass detection, especially if detection features are weak or outdated.

Deferred human review

In many systems, questionable bills are flagged and held for human review (e.g. bank staff) rather than instantly rejected. This means some counterfeits may slip through initially.

Older ATM models lacking full sensors

Older or lower-end ATMs may lack full UV / IR / magnetic scanning capabilities. They are more vulnerable to counterfeits.

What Happens If a Fake Bill Is Dispensed?

Even though rare, receiving counterfeit money from an ATM can happen. Here’s what usually follows and what you should do:

- The ATM may detect it and retain the bill instead of handing it to the user.

- The bank or machine operator is often notified so they can inspect the suspect note.

- If a user reports receiving a counterfeit note, the bank might reimburse them after verification.

- Authorities (police, central bank, or secret service) may get involved to investigate the source.

From the user side:

- Save all transaction details (time, location, receipt).

- Report immediately to your bank or to authorities.

- Do not try to pass the bill on or destroy it (it may be evidence).

Note: banks generally treat counterfeit banknotes as worthless and may not compensate if the note is proven fake and not their fault. NerdWallet

Why It Matters to ATM Business Owners

As an ATM operator, understanding detection of fake bills is crucial because:

- Risk management & liability: If your machine dispenses a counterfeit, customers can blame you or your processing partner.

- Maintaining trust & reputation: Users expect secure ATM processing and confidence in cash dispensed.

- Operational integrity & audits: Machines with weak detection increase your exposure to fraud and losses.

- Choosing the right equipment: You’ll prefer ATMs with advanced validators, better transaction technology, and regular calibration.

- Transparent fee justification: For ATM operators charging for processing or maintenance, showing you use secure, high-tech machines helps justify your pricing.

Best Practices & Recommendations

- Use modern ATM models with full-spectrum detection (UV, IR, magnetic, image).

- Maintain frequent calibration, cleaning of sensors, and software updates.

- In cash-recycling machines, aggressively isolate and test deposited bills before reuse.

- Keep logs, images, and records for suspect bills for audits or investigations.

- Train staff to handle counterfeit reports and liaise with authorities.

- Monitor cash supply chains, ensure the cash you load into machines is from verified sources.

- When selecting a ATM processing solution, emphasize secure ATM processing and lower operational risk.

Final Thoughts

So, can ATMs detect fake bills? Yes, modern machines use multiple detection systems (optical, UV, IR, magnetic, physical measurement) to flag counterfeit attempts. But no system is perfect. Risk remains, especially from advanced counterfeits, recycling machines, or older ATM units.

For ATM business owners, the key is: choose robust hardware, maintain it, and integrate these features into your security protocols. That way your machines serve customers with confidence, and you maintain one of the best ATM processing solutions in your network.