The Untapped Revenue Stream You Might Be Missing

If you’ve ever wondered, Are ATM machines profitable? the short answer is yes, often far more than most business owners expect. ATMs are not just cash dispensers; they’re reliable profit engines that can increase foot traffic, enhance guest experience with ATM Link, and deliver steady, predictable income.

Whether you own a convenience store, restaurant, or hospitality venue, understanding ATM revenue is key to deciding if this investment fits your business model. Let’s break down the profit potential, the numbers behind it, and the myths you should ignore.

How ATM Machines Make Money

ATM owners earn money primarily through surcharge fees, a small fee charged to customers for each transaction. On average, this surcharge is between $2 and $3 in the U.S.

Here’s how it works:

- A customer withdraws $60 from your ATM.

- They pay a $2.50 surcharge.

- That $2.50 goes directly to you.

Over time, these small amounts add up to a substantial monthly income.

But surcharge fees aren’t the only source of income from ATMs. Other revenue streams include:

Interchange Fees: Every time a customer uses a debit or credit card at your ATM, your processor pays you an interchange fee. Over many transactions, this can add up and boost your overall revenue.

Dynamic Currency Conversion (DCC): For ATMs in tourist-heavy or international locations, DCC lets foreign cardholders convert withdrawal amounts into their home currency, often for a small conversion fee. This creates extra income beyond the standard surcharge.

Credit Card Surcharge (CCS): Some ATMs also earn revenue from cash advances by applying incremental fees on credit card cash withdrawals, adding another layer of income.

Together, these additional revenue streams combined with surcharge fees can significantly increase the profitability of your ATM.

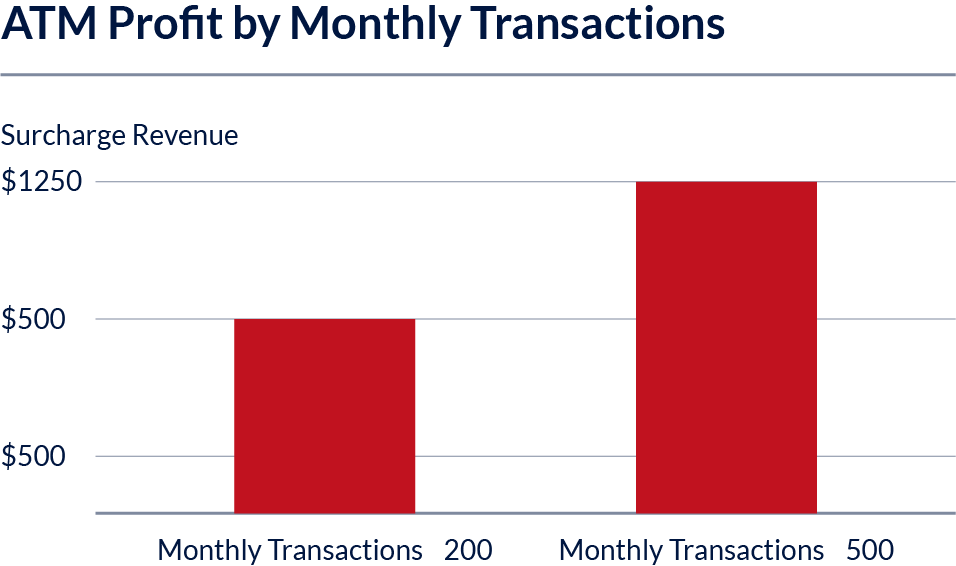

Real-World Profit Examples

- Low Traffic Location (200 transactions/month)

200 × $2.50 = $500/month in surcharge revenue - High Traffic Location (500 transactions/month)

500 × $2.50 = $1,250/month in surcharge revenue

And that’s just from surcharges. Many store owners also see a 10–20% boost in retail sales because customers who withdraw cash often spend part of it immediately. That means ATMs can improve profits in more ways than one.

Factors That Affect ATM Profitability

1. Location Is Everything

An ATM placed in a busy area like a gas station, nightclub, or tourist spot will perform significantly better than one in a low-traffic zone.

2. Surcharge Amount

Balancing customer satisfaction with profitability is key. Too high a fee can discourage use; too low and you miss out on income.

3. Transaction Volume

Foot traffic, customer demographics, and nearby competition (such as banks or other retail ATMs) all influence how many people will use your ATM.

4. Processing and Ownership Model

Full ownership means higher profits but also greater responsibility for machine upkeep and cash replenishment. Partnership models offer lower (yet still worthwhile) profits while reducing your operational workload. To ensure you’re getting the most commission from your ATM, explore strategies that maximize surcharge revenue while keeping customers happy.

Busting Common ATM Business Myths

When researching ATM ownership, you might run into misinformation. Let’s clear the air:

- Myth #1: ATMs require constant maintenance.

Reality: Modern machines need minimal upkeep most issues can be handled remotely. - Myth #2: ATM businesses aren’t profitable anymore.

Reality: Cash usage remains strong in many sectors, especially small businesses, events, and hospitality. - Myth #3: You need a large chain of ATMs to make money.

Reality: Even a single machine can be highly profitable in the right location.

For more misconceptions, check out ATM business myths and see the truth for yourself.

How ATMs Boost Business Beyond Surcharges

Installing an ATM can directly boost sales for convenience stores and other retail businesses. When customers have cash in hand, impulse spending increases, often leading to bigger basket sizes and more frequent visits.

In the hospitality sector, ATMs can enhance guest experience with ATM Link by offering on-site cash access, making your venue more convenient and appealing.

Conclusion: Turning Small Fees into Big Profits

So, are ATM machines profitable? When placed strategically and managed properly, they can deliver thousands in annual revenue and boost your business’s overall performance.

Ready to see if an ATM fits your business? Contact ATM Link for a free consultation.

FAQs

Q1: How much does an ATM cost?

Most ATMs range from $2,200–$8,000, depending on features.

Q2: How quickly can I make my investment back?

Many owners recover costs within 6–18 months, depending on location and ATM usage.

Q3: Do I need a special license to operate an ATM?

You may need a business license and must comply with federal regulations.

Q4: Can ATMs boost retail sales?

Yes, retailers often report a 10–20% increase in sales after installation.

Q5: Are ATMs still used in the digital payment era?

Absolutely. While digital payments grow, cash remains vital in certain industries and demographics.