If you operate ATMs in 2026, the question isn’t whether crypto is volatile; it’s whether you should add Bitcoin to your ATM and increase the earning potential of the ATM machine you already own.

Through the ATM Link × LibertyX partnership, operators can now activate regulated Bitcoin functionality directly on eligible retail ATMs. No new kiosk. No additional lease. No extra floor space. Just new revenue layered onto your existing footprint.

Why Add Bitcoin to Your ATM Instead of Installing a New Crypto Kiosk?

It’s a revenue strategy.

Bitcoin ATM transactions continue to grow, retail crypto adoption is expanding, and consumers are actively seeking cash-to-crypto access in familiar locations.

The real question isn’t:

“Is this risky?”

It’s:

“Can I afford to ignore it?”

Let’s talk with facts.

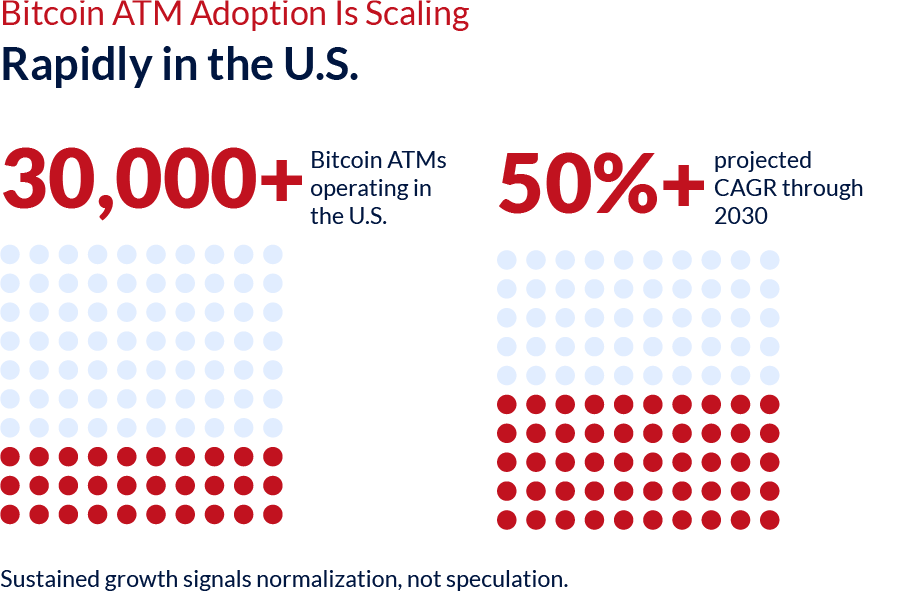

Bitcoin ATM Growth in the U.S. Is Real, Not Hype

According to industry tracking data, the United States hosts over 30,000 Bitcoin ATMs, representing the majority of global installations. Market research projects the global crypto ATM sector to grow at a CAGR exceeding 50% through 2030.

That kind of growth happens when:

- Consumer demand stabilizes

- Compliance improves

- Retail integration becomes normalized

Operators can now add Bitcoin to their ATM without installing a separate kiosk, using regulated, software-based activation.

Crypto Adoption Is Now Mainstream Retail Behavior

Recent consumer studies show that nearly 1 in 5 U.S. adults have owned cryptocurrency, and a similar share plans to purchase crypto again within the next year.

That represents millions of consumers.

Crypto adoption is strongest among:

- Ages 18–49

- Urban retail shoppers

- Gig economy workers

- Underbanked communities

And where do these consumers shop?

Convenience stores.

Gas stations.

Local retail.

Exactly where your ATM already operates.

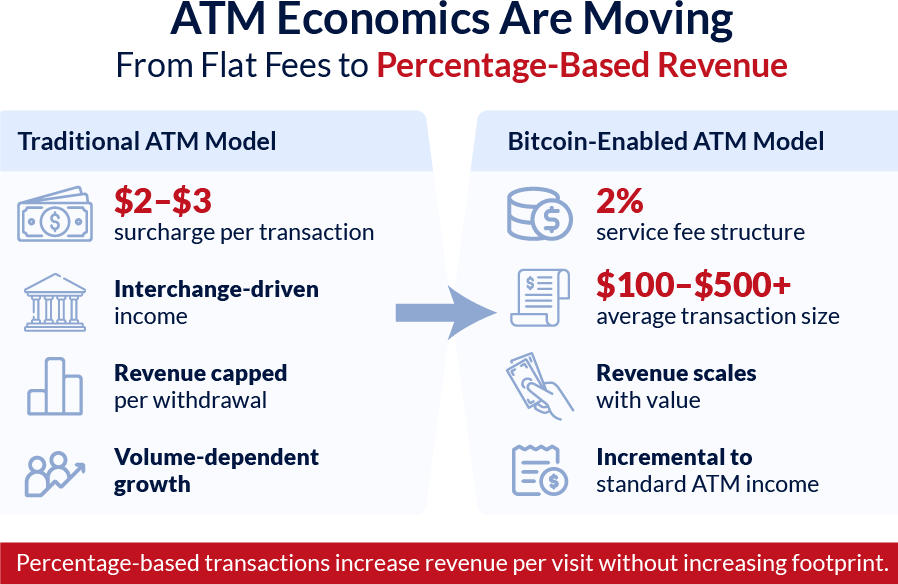

Traditional ATM Revenue vs Bitcoin-Enabled ATM Revenue

For operators, the opportunity is financial.

Traditional ATM Model:

- $2–$3 surcharge

- Interchange revenue

- Increasing competitive pressure

- Naturally capped margins

Traditional ATM income remains stable, but it is naturally capped. Independent deployers can add Bitcoin to their ATM footprint without increasing lease costs.

Bitcoin-Enabled ATM Model:

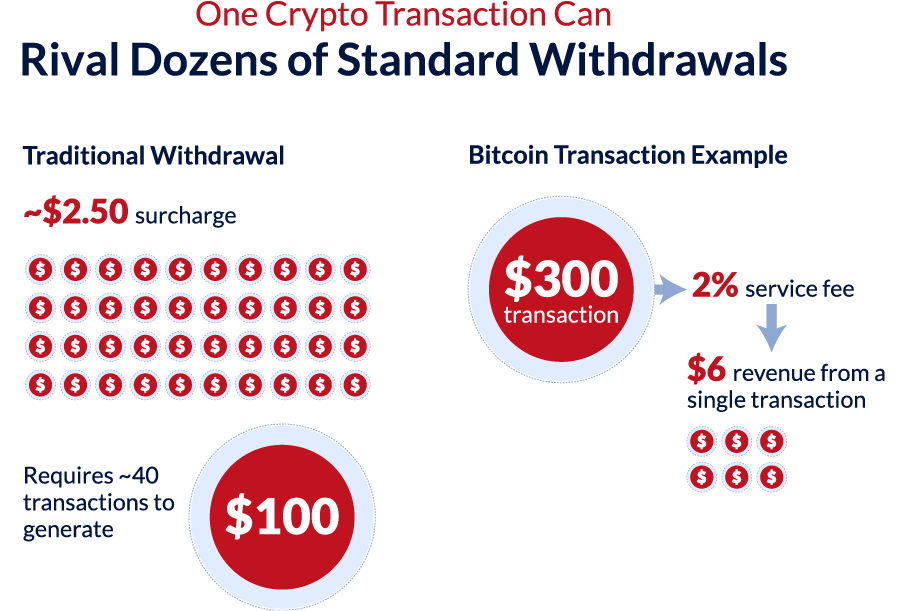

Bitcoin transactions typically generate:

- Percentage-based service (often 2%)

- Larger average transaction sizes ($100–$500+ retail range)

- Incremental income layered onto standard ATM activity

Even moderate crypto transaction volume can rival or exceed dozens of standard surcharge transactions, and importantly, it does not replace traditional ATM revenue. It adds to it.

Cash Is Fueling Crypto Access

Crypto adoption isn’t replacing cash; it’s expanding how cash is used.

Millions of U.S. households remain unbanked or underbanked, and many consumers prefer not to link personal bank accounts to online exchanges. They value:

- Cash accessibility

- Immediate confirmation

- In-person retail trust

Retail ATMs bridge that gap. Your machine already processes cash. Bitcoin functionality simply monetizes that capability in a higher-margin way. The decision to add Bitcoin to your ATM is about more income, not guesswork.

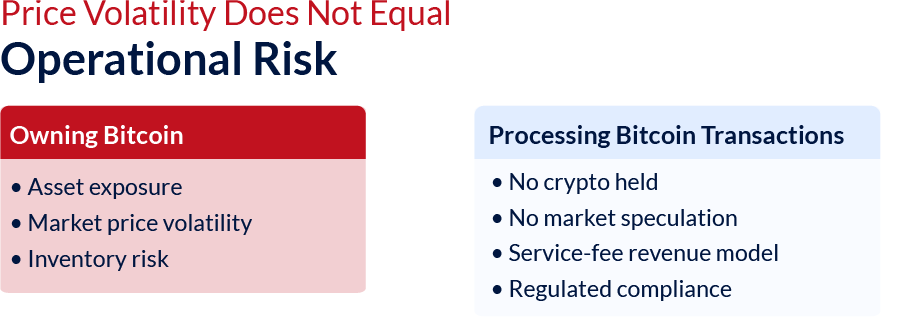

Is Adding Bitcoin to Your ATM Risky?

Let’s separate myth from mechanics.

Owning Bitcoin carries price volatility.

Processing Bitcoin transactions does not.

When enabled through a regulated platform like LibertyX, operators:

- Do not hold crypto inventory

- Do not speculate on the market price

- Do not assume asset risk

You provide transaction access. That’s service revenue.

Big difference.

Regulation in 2026 Is Stronger Than Ever

Crypto regulation has matured significantly. Today’s ecosystem includes:

- FinCEN compliance frameworks

- State-level licensing requirements

- KYC and AML enforcement

- Enhanced consumer protection oversight

Regulated crypto ATM providers now operate under structured compliance frameworks. This dramatically reduces operational risk for independent ATM deployers.

Consumer Preference: Trust Wins

Standalone crypto kiosks exist, but consumers consistently prefer:

- Familiar retail environments

- Recognized ATM brands

- Trusted store locations

A Bitcoin transaction inside a convenience store ATM feels safer than a standalone machine in isolation.

That psychological trust factor drives usage.

Your ATM already benefits from:

- Prime retail placement

- Consistent daily foot traffic

- Established customer familiarity

Bitcoin activation leverages that built-in trust.

Activate Bitcoin on Your Existing ATM

Bitcoin enablement through ATM Link × LibertyX is software-driven.

Operators do not need:

- New kiosks

- Additional leases

- Extra floor space

- Separate hardware installations

Same machine. Same location. Higher-margin transactions.

That’s capital efficiency.

Frequently Asked Questions

Do people still use Bitcoin ATMs in 2026?

Yes. Transaction volumes continue to grow in retail locations, especially in cash-heavy communities and urban markets.

Is crypto ATM demand seasonal?

Crypto markets fluctuate, but baseline retail access demand remains consistent due to ongoing adoption.

Will Bitcoin transactions replace traditional ATM income?

No. They supplement it. Traditional surcharge income remains stable while crypto adds incremental margin.

Is this only for large operators?

No. Independent ATM deployers can compete without installing bulky standalone crypto kiosks.

Are regulated crypto platforms safer now?

Yes. Regulatory frameworks and compliance enforcement have strengthened significantly since 2021.

Why Your ATM Is a Better Fit!

Large crypto ATM companies dominate standalone installations.

But independent ATM networks still control tens of thousands of traditional retail ATMs.

That’s leverage.

Instead of competing with new hardware…

You can activate higher-margin services inside your existing footprint.

Smarter scaling.

Lower overhead.

Higher ROI per location.

Why This Is a Revenue Move, Not a Risk

Let’s simplify everything:

You already:

- Manage ATM connectivity

- Process cash withdrawals

- Maintain compliance standards

- Operate in high-traffic retail environments

Adding Bitcoin:

- Increases revenue per machine

- Attracts new customer segments

- Enhances competitiveness

- Requires minimal operational change

That’s not speculation. That’s monetization.

Final Takeaway

Interchange margins are stabilizing. Retail crypto adoption is expanding.

Cash remains essential in many communities. Regulatory oversight is stronger. Demand for physical crypto access is growing.

In 2026, enabling Bitcoin on your ATM is a strategic upgrade, not a gamble.

Ready to Unlock Higher-Margin Transactions?

Switch to ATM Link to unlock multiple revenue streams from your existing ATM footprint, not only from traditional ATM transactions, but also from Bitcoin enablement, credit card segmentation, and Dynamic Currency Conversion.

Through the ATM Link × LibertyX partnership, operators can layer higher-margin Bitcoin transactions on top of expanded card revenue opportunities, creating a more profitable machine without adding new hardware.

Speak with ATM Link to evaluate your network and start upgrading your income potential today.